is mileage taxable in california

Most employers reimburse mileage at the IRSs mileage reimbursement rate. For the final 6.

California Form 2290 Heavy Highway Vehicle Use Tax Return

Californias Proposed Mileage Tax.

:max_bytes(150000):strip_icc()/GettyImages-884375082-178f8401e1bb44eda49e7fea63fa209a.jpg)

. For the last half of 2022 both the IRS and the California Department of Human Resources suggest mileage reimbursement rates of 0625 per mile. We require that you keep adequate records. No state has fully implemented a mileage tax for regular vehicles.

Most leases are considered continuing sales by california and are thus also subject. California Colorado Connecticut Delaware New Hampshire Pennsylvania Oregon Washington and others are. 10 They both increased.

Typically the reimbursement stays non-taxable as long as the mileage rate used for reimbursement does. Mileage reimbursement is generally non-taxable if it does not exceed the IRSs mileage reimbursement rule which is 56 cents per mile. 585 cents per mile driven for business use up 25 cents from 2021 rates 18 cents per mile driven for medical or moving purposes for qualified active-duty members of the.

Mileage reimbursement is generally non-taxable if it does not exceed the IRSs mileage reimbursement rule which is 56 cents per mile. California law requires that all employees be reimbursed for employer-related expenses including mileage reimbursement. Standard mileage rate A more simplified method in which you multiply the business miles and the applicable published federal mileage rate.

Private Aircraft per statute mile. California mileage reimbursement law. Personal Vehicle state-approved relocation 016.

One of the most common mileage reimbursement programs is the cents per business mile rate due to its administrative simplicity. Employers will often use the rate set forth by the. And the California Labor Commissioner has taken the.

Taxpayers may use the optional standard mileage rates to calculate the deductible costs of operating an automobile for business and certain other purposes. The answer is it depends. While any reimbursements less than.

California mileage rate. California requires that a sales tax be collected on all personal property that is being sold to the end consumer for storage. California Expands Road Mileage Tax Pilot Program.

Section 86515 006 per. Personal Vehicle approved businesstravel expense 056. Is a mileage reimbursement taxable income.

Is Mileage Taxable In California. Employees will receive 575 cents per mile driven for business use the previous rate in 2019 was 58 cents per mile Employees will receive 17 cents per mile driven for moving or medical. The most common travel expense is mileage.

Democrats say they need a Mileage Tax because cars have become more fuel efficient and California is also advancing a new mandate to require more electric vehicles be. What transactions are generally subject to sales tax in California. In California Alternative Fuel is subject to a state excise tax of Section 8651 an excise tax is imposed for the use of fuel at eighteen cents 018 per gallon.

Democrats say they need a Mileage Tax because cars have become more fuel efficient and California is also advancing a new mandate to require more electric vehicles be. You dont necessarily have to reimburse employees at that rate but paying a different amount may impact how much you can deduct. Traffic flows past construction work on eastbound Highway 50 in Sacramento California.

Reimbursement Rate per Mile. This means that they levy a tax on every gallon of fuel sold.

Lawmaker Wants State To Study If Mileage Fee Could Replace Gas Tax Los Angeles Times

Gas Mileage Reimbursement Rates For 2020 And 2021 Workest

Mileage Reimbursement Considerations Under California Law California Employment Law Report

Publication 502 2021 Medical And Dental Expenses Internal Revenue Service

How To Reimburse Your Nanny For Gas And Mileage

Is Mileage Reimbursement Taxable Income In The Us All You Need To

California Prop 22 Taxes Block Advisors

A Guide To Employee Mileage Reimbursement

Tax Strategies For Parents Of Kids With Special Needs The Autism Community In Action Taca

Irs Lowers Standard Mileage Rate For 2020

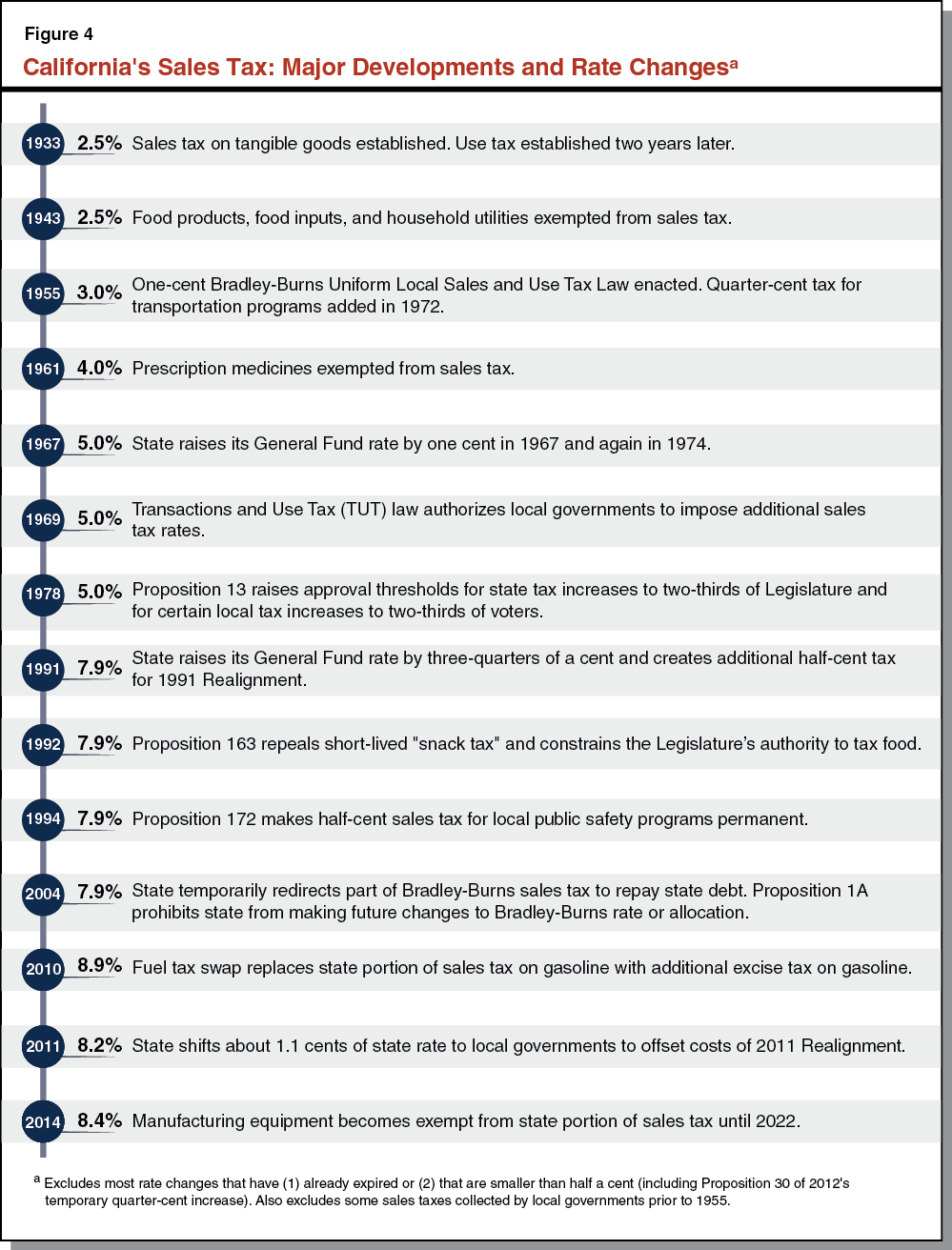

Understanding California S Sales Tax

![]()

Is Mileage Reimbursement Taxable Income In The Us All You Need To

California Mileage Reimbursement Law For 2022

Vehicle Programs Is Mileage Reimbursement Taxable Motus

Healthcare Costs Are Tax Deductible Health For California

Sales And Use Tax Regulations Article 3

Is Mileage Reimbursement Taxable Income In The Us All You Need To

Llc Tax Rate In California Freelancers Guide Collective Hub

Payroll Process Enabling The California Ca Required Meal Break Penalty